ABN AMRO Pensions

Modernising and simplifying the everyday banking experience for Pension clients (balances, setting up a pension account, transfers, saving, investing and pay-outs) to create a minimal, transparent and informative banking environment. All designed with the user in mind from the beginning until the end of the process.

Challenge

Within the Pensions team of ABN AMRO the goal was to deliver a brand new online environment for their pension clients. The new environment would enable customers to view, analyse, invest, and monitor their pension. I worked on several product flows. The main flows we created were a pension request flow in which the customer can request a pension. The pay-out flows. This happens when a customer reaches their retirement date. And the general online environment for customers to review their balance, add additional investments or make any changes in their products. We designed, user tested and usability tested these flows endlessly to migrate the platform eventually successfully.

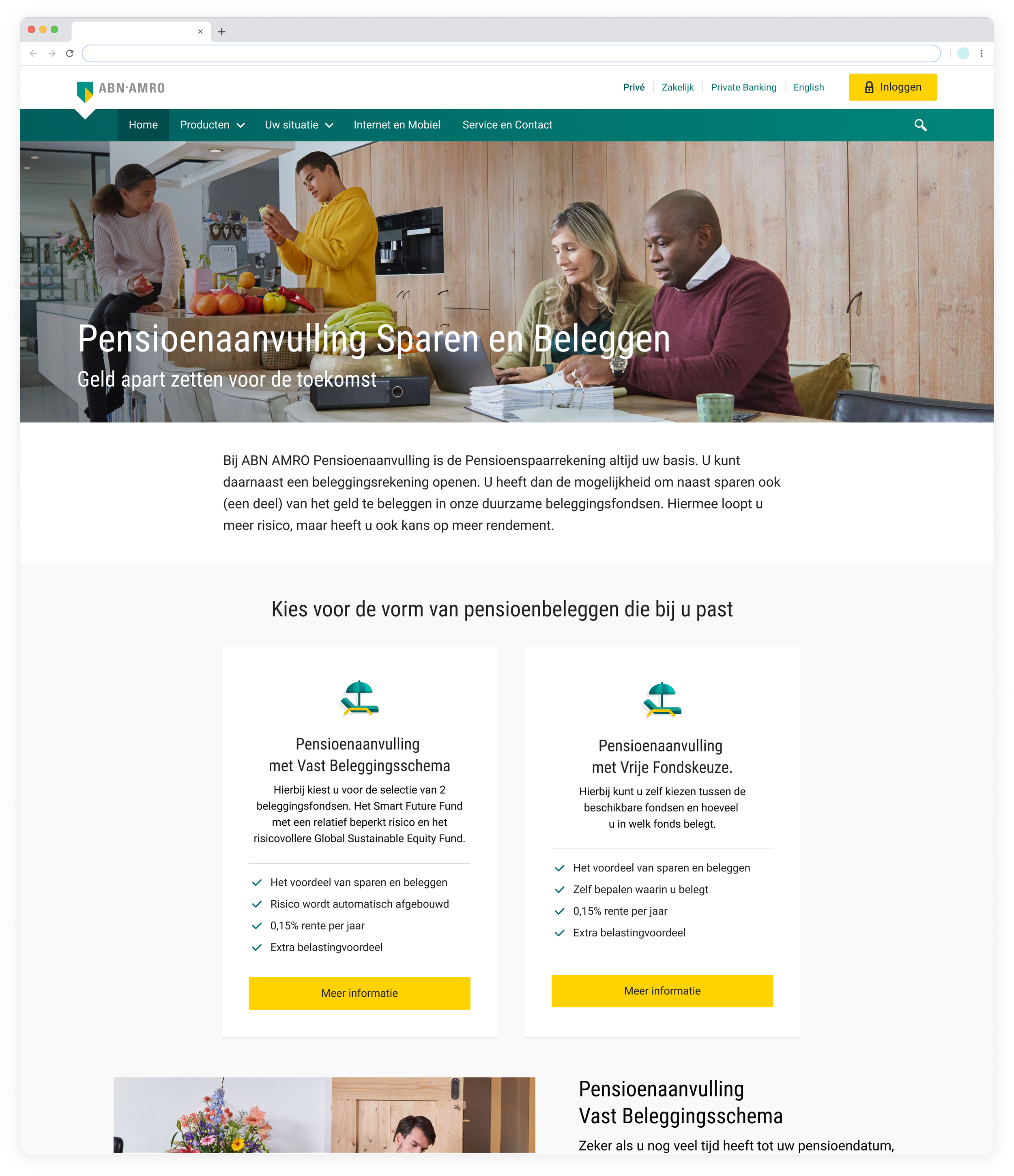

Until now customers only had the option to get a savings product. We wanted to reuse this flow and create a similar request flow for customers to recognize and change it into an invest flow. In this new product the client is flexible to choose a fixed investment product or a flexible investment product. In the fixed product the investment fund has been carefully put together by the bank and the client doesn’t have to think too much. In the flexible product the customer can choose its own investment products and is willing to take more risk but also to have more control over their investments.

Request a pension invest product

On the public website the customer is informed about the different products. Here the customer can choose between a fixed or flexible investment product. In both cases the client needs to open a banking and savings account aswel. This is mandatory and standard. On top of that the customer needs to go through a 3 questionnaires. One to check their investment knowledge, one to check their pension knowledge and one to check if they don’t pay tax in the US. This makes the request flow very lengthly so I tried to solve this with smart UX choices, to make the flow as comprehensive and easy as possible. My biggest worry was that customers would not finish the request flow because of its length which would ultimately kill conversion. I decided to test this during user testing.

This is a part of the whole Pension request flow. It didn’t even fit the screenshot.

And it also needed to be prototyped so I could test it during User Testing.

User testing

My goal for the user testing was to measure if users understood the questions asked in the questionnaires. I wanted to know if they thought the flow was too long, if there were too many questionnaires and general feedback for improvement. Surprisingly most users said that the questions asked were very positive. They responded very well and thought that the questions we asked about their investing knowledge were good. They were used to answer these types of questions because they had filled them in on investment platforms aswel. The length of the flow was no problem because they expected to fill in a lot of information beforehand. And a progress bar indicated how far they were in the process.

I did get good feedback on the way the questions in the questionnaires were asked. Mostly on the copywriting. They could usually guess which answer was the right one even if they didn’t know the answer. Which made me dive deeper into biased questions and answers and the psychology of questionnaires.

This is the introduction screen in which clients see the different steps they have to take in order to request their investment pension product. This screen tells customers they also need to open a bank account beforehand and introduces them to all the steps.

Knowledge test

In the fist questionnaire we test the customers general knowledge about pensions. This is a mandatory test to understand the clients financial situation and to check if they understand all the requirements of this financial product. We ask them for example if they need this money for their daily expenses. If so they won’t pass the test and they will not be able to request a pension product. I tried to use collapsed containers so that all the questions fit on one screen. In this way it looks like the flow is a lot shorter and more comprehensive. I made use of the ABN AMRO Design System components.

1. Pension knowledge questionnaire

Investment knowledge questionnaire

We ask the customer if they were nervous to invest money. This was received very well by the respondents during user testing. They thought it made the bank look more human and empathising.

2. Investment knowledge questionnaire

Add money to your pension account

The next step is to add money to their product. The customer can choose to use their “jaarruimte” thats the yearly maximum allowance to add to your pension account. But we also allow the customer to transfer money from another bank/insurance or to add money which was received from the ending of a contract at a past job.

To open an account there are some costs that need to be payed. This happens in the same flow. We ask from which account this payment can be done.

The customer can check all their information and read the important documents. If they change their mind they can always edit any details and go back to change this quickly.

Feedback

Once everything is signed and confirmed we show the client a feedback screen. This is a positive message that their account is created and some steps and information on what to do next and what to expect. The customer can already add money to their account.

Success

The customer has now opened their brand new pension product and can see this in the online environment - Pension Overview. In this overview they can also check how much money they need to invest to have a good monthly income when they retire and make any changes to their products.